How Financial Markets Move

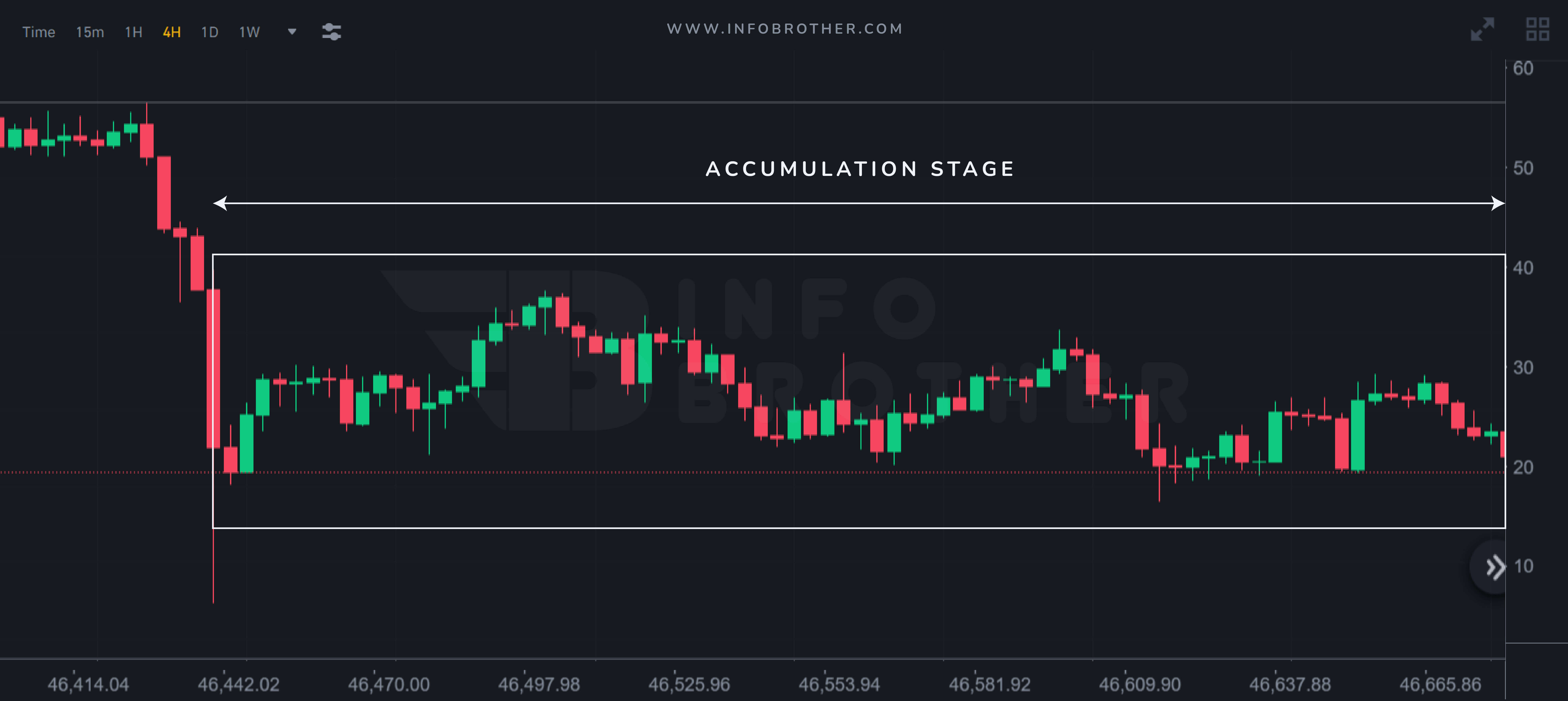

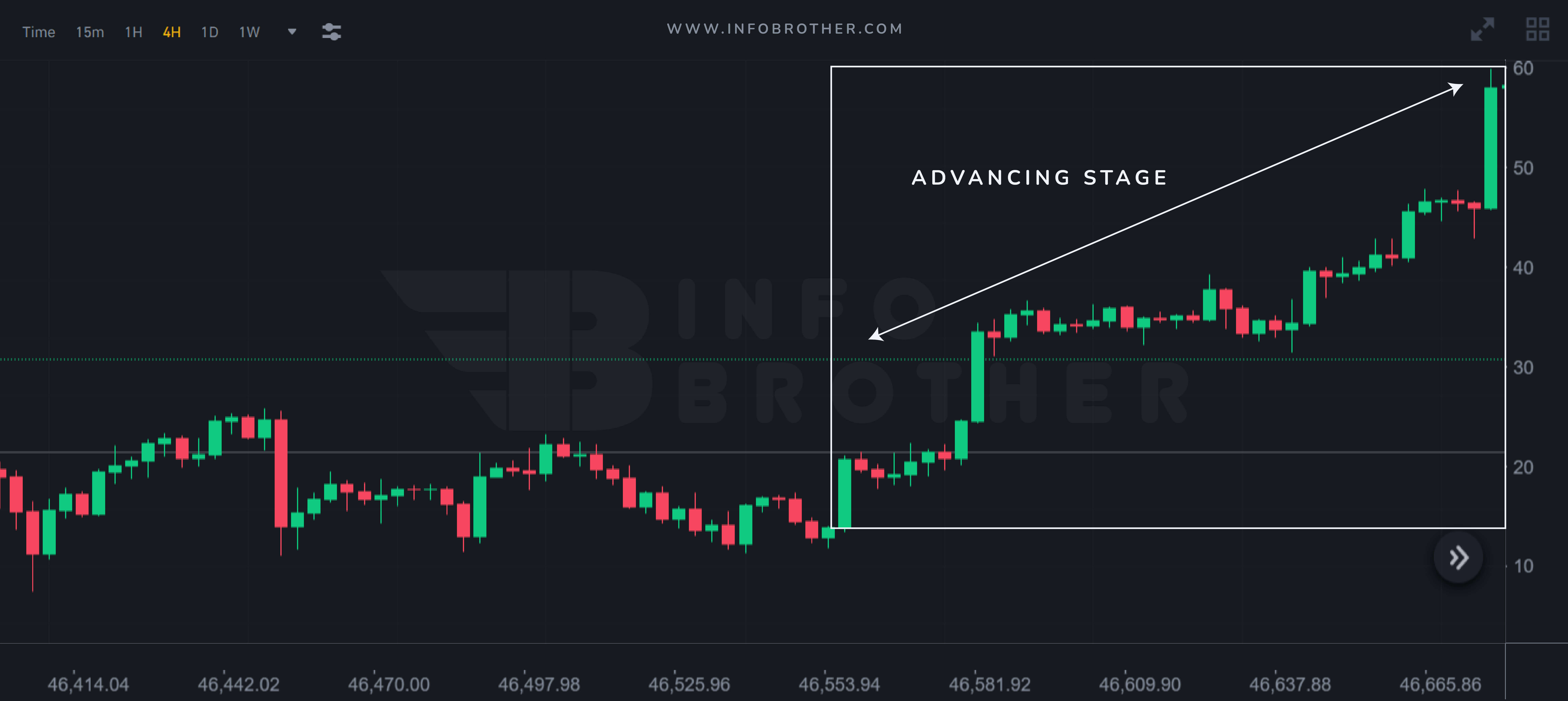

Learn about the four key phases: accumulation, markup, distribution, and markdown.

Whether we should buy, sell, or remain away from the markets is determined by the market structure. To assist us decide where to purchase or sell, we may use a value zone, such as support and resistance or a moving average. Candlesticks create patterns that, once completed, predict price direction. This colorful technical instrument , which goes back to 18th-century Japanese rice dealers, gains depth with proper color coding.

To trade price movement, a trader must first understand market structure. If we don't grasp the market, we won't be able to purchase, sell, or remain out of it. However, understanding market structure offers up a world of opportunities for us.