eBOOK/PDF

No ads? No problem! You can download our tutorials in a printable PDF format or as an EPUB file, optimized for your tablet or eReader.

Bearish Pennant Pattern

Master the Bearish Pennant Pattern: A Guide to Trading Continuation Patterns.

Pennant patterns are market continuation patterns that are utilized by traders to forecast future market moves. The pennant pattern, like the triangle pattern, has several significant factors to remember when trading.

In this chapter, we'll study what a pennant pattern is and how to spot one in a chart. We'll go through how to use this pattern to make better deals.

| Name: | Bearish Pennant |

|---|---|

| Forecast: | Continuation Pattern |

| Trend prior to the pattern: | Downtrend |

| Opposite pattern: | Bullish Pennant |

| Accuracy rate: | 84% |

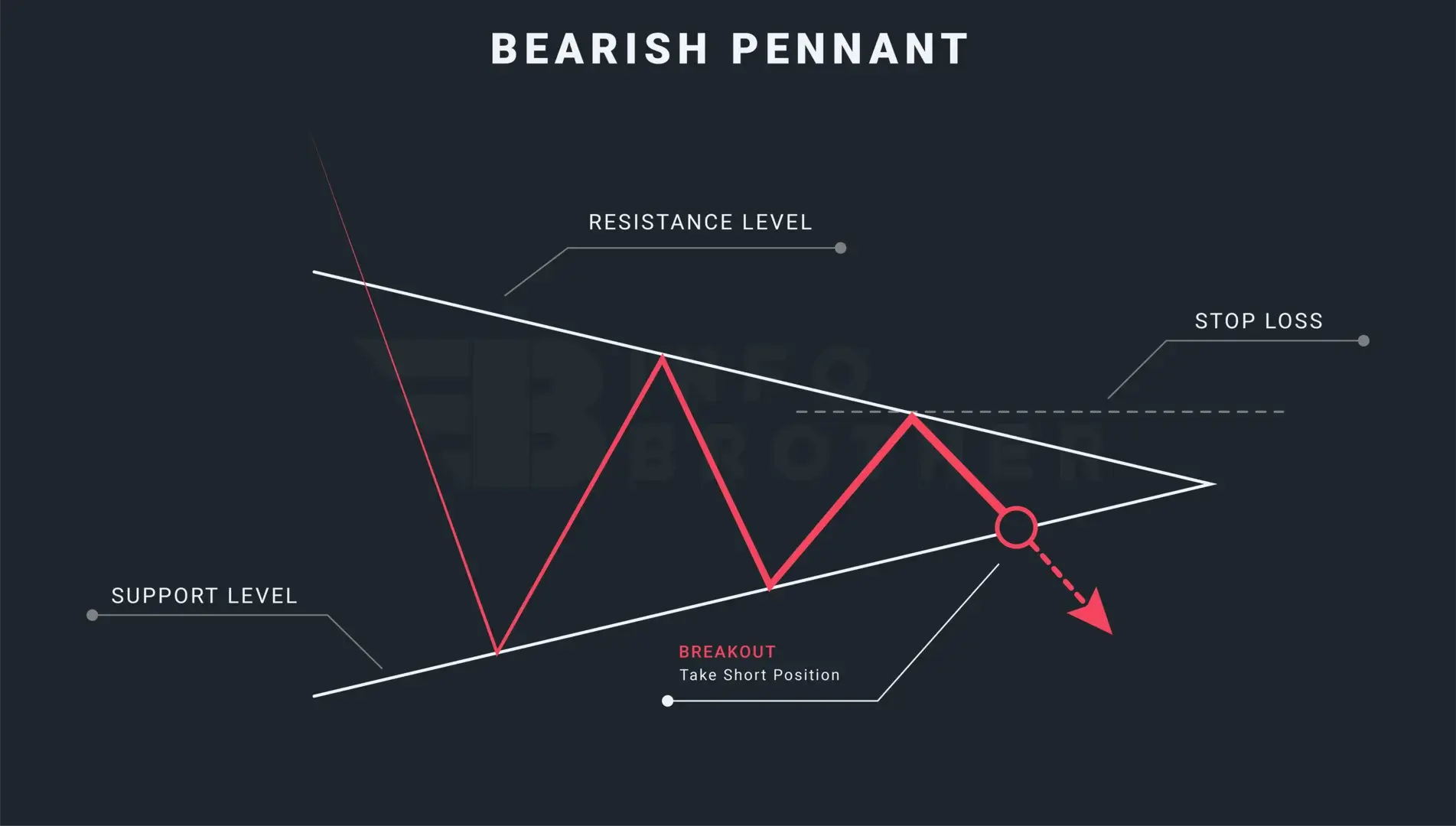

The continuation chart pattern known as a "bearish pennant" frequently occurs before a price movement in the direction of the preceding trend. This pattern is visible to traders when there is a significant downward trend in the market, followed by a temporary consolidation. The pennant design resembles a little symmetrical triangle constructed of a lot of candlesticks.

Depending on the possible future price movement after the breakout from the structure, pennants can be bullish or bearish in nature.

Because they offer a good risk-reward ratio when handled correctly, pennant patterns are regarded by experienced traders as the most trustworthy chart-based trading patterns. The pennant patterns, on the other hand, are fractal in nature, which means that they may appear at all lengths of trend, from the smallest to the longest. They can also develop in any openly traded, liquid market.

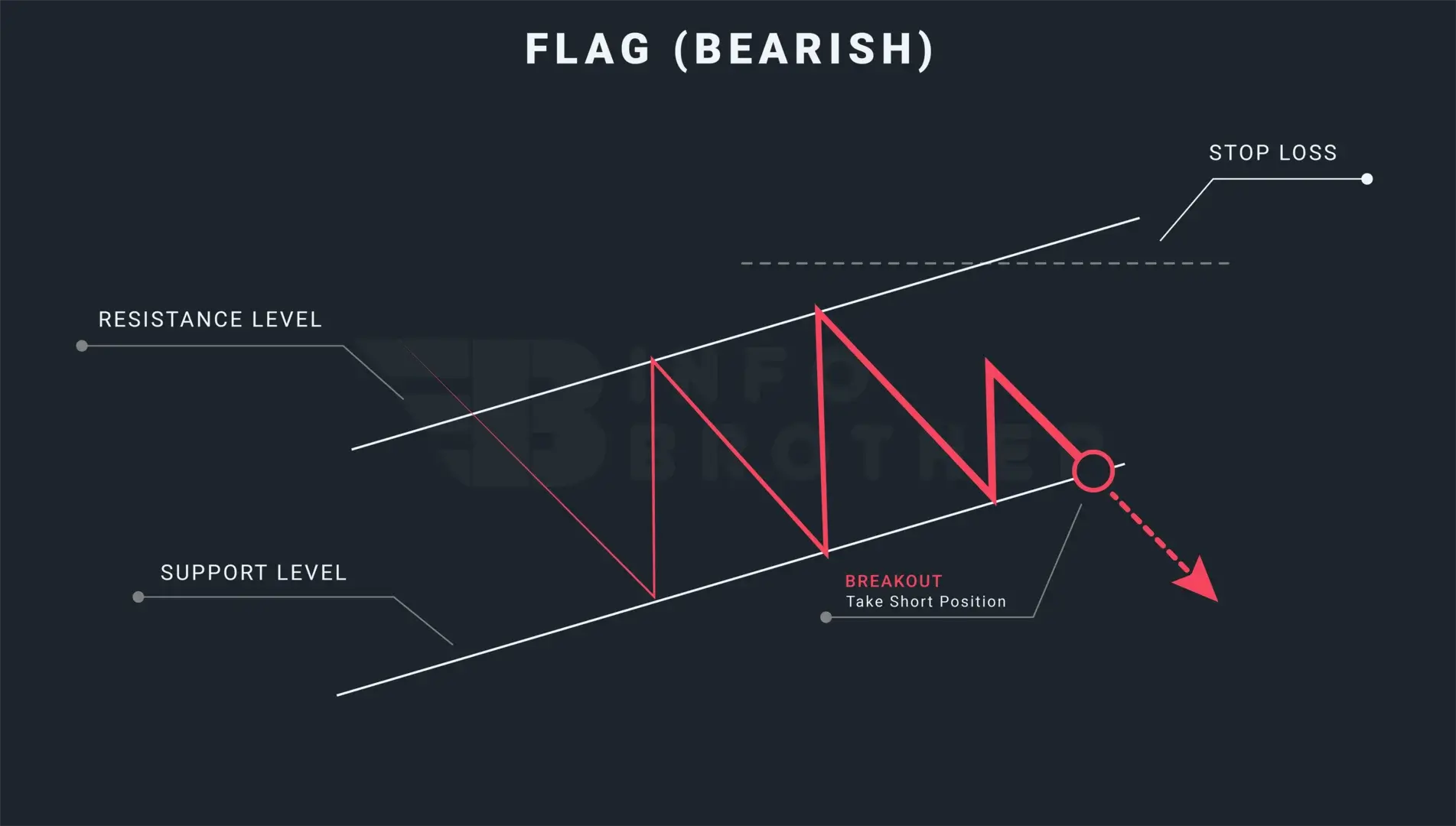

The majority of traders equate flag patterns to pennant patterns. However, these two designs couldn't be more unlike one another. The appearance of the support and resistance levels inside the formations is the primary distinction between the flag pattern and the pennant pattern. Flag patterns consist of two parallel lines, whereas pennant patterns have support and resistance lines that converge towards an apex.

The pennant formation seems to be a little symmetrical triangle with convergent trendlines that enclose the price movement. Due to this pattern's high accuracy rate, traders should pay attention to it. If this pattern develops during a downward trend, there is an 84 percent likelihood that the trend will continue.

A few crucial factors to think about while attempting to identify a bearish pennant pattern are stated below.

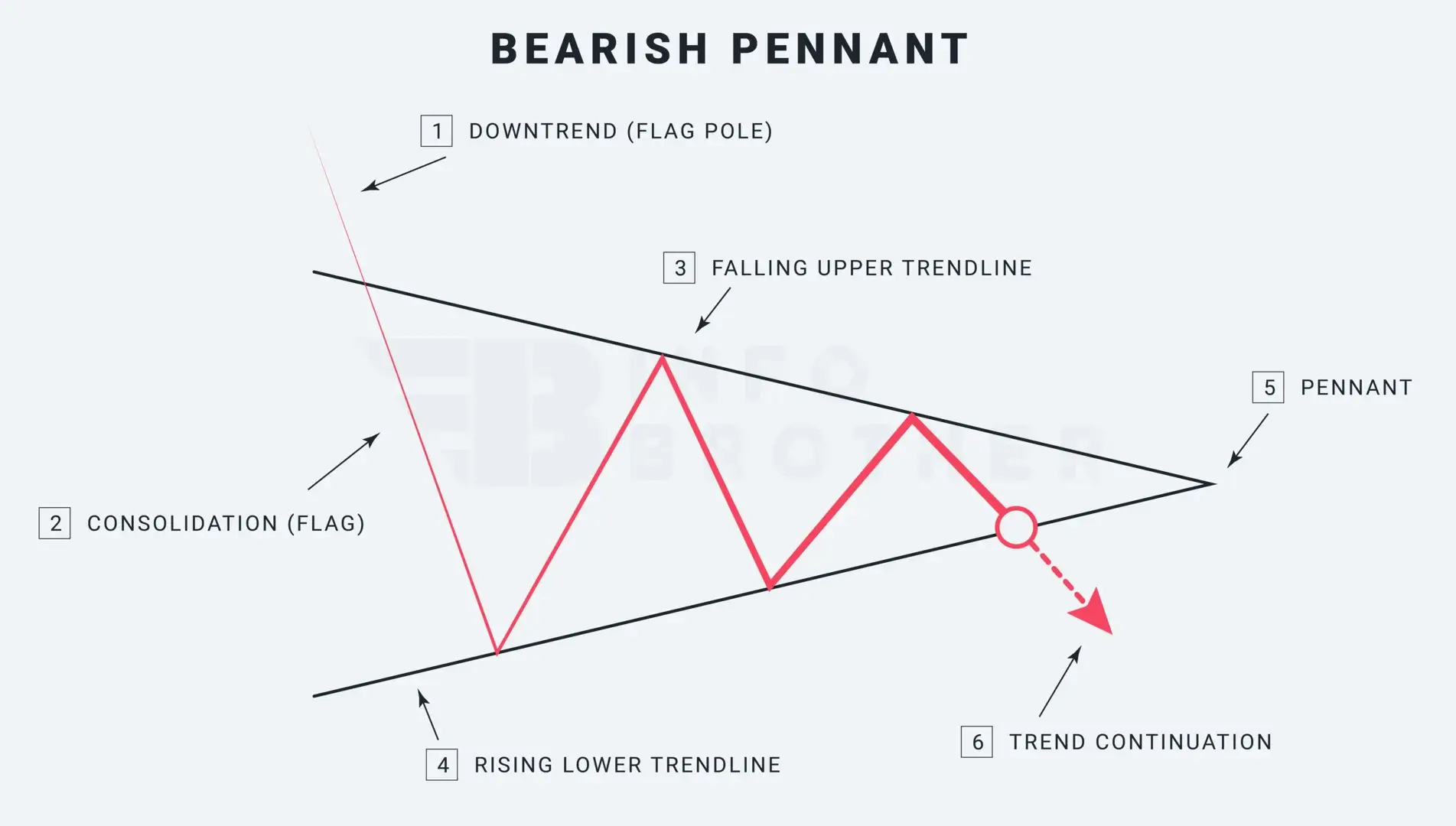

1. Downward trend (Flagpole)

The market must be in a downward trend prior to the bearish pennant pattern forming. The difference between this pattern and others like the symmetrical triangle is that this pattern always starts with a flagpole. Traders should avoid trading this pattern if the trend is upward or sideways. The symmetrical triangle is preceded by the initial strong movement, the flagpole.

What is the flag?

A "flag" is a term used in technical analysis. It is a pattern that develops anytime there is a strong gain or decline, followed by trading inside a small price range, and then it is finished off by another sharp rise or decline.

2. Consolidation

The market is experiencing a sharp fall before entering a phase of consolidation. The market will see a brief period of consolidation before experiencing another significant downturn to finish the pattern.

3. A falling upper trendline

Draw the trend line or resistance level during the consolidation stage by connecting the highs. We need to have at least two swing highs in order to construct the upper trendline or resistance level. However, more trendline interactions lead to more reliable trading outcomes.

4. Rising lower trendline

When the market is consolidating, draw another rising lower trendline or support level by connecting the lows. We need at least two swing lows in order to create trendlines or a support level. However, more trendline interactions lead to more reliable trading outcomes.

5. The Pennant

A pennant is a little symmetrical triangle that, like a cone, begins broad and converges as the pattern evolves. A pennant shape is formed by drawing an upper falling trendline and a lower rising trendline.

What exactly is a symmetrical triangle?

A symmetrical triangle is a chart pattern formed by two converging trendlines, with the top trendline or resistance level decreasing and the lower trendline or support level increasing. Although the previous trend is generally continued, this pattern shows an even balance between buyers and sellers.

6. Continuing the trend

In the case of a bearish pennant, the previous declining trend has resumed after the breakout, when the price falls below the support level. The candle that emerges from the pennant pattern ought to do so with strong volume and an accelerating pace. Bearish Marubozu candles that breach the support line are typically found.

The trendlines of the pennant patterns must have a minimum of two swing highs and two swing lows. However, more trendline interactions lead to more reliable trading outcomes.

The Difference Between a Flag Pattern and a Pennant Pattern:

The look of the support and resistance levels inside the formations is the primary distinction between a flag pattern and a pennant pattern.

Read More

Before entering a trade following a fast and severe price change, traders should wait for the breakout. The pennant pattern predicts that after the swift price movement, there will likely be a breakout and continuation in the original move's direction.

Given that the move was rather large, a stop-loss can be set at the high of the breakout candle; alternatively, for traders who are more cautious, a stop-loss can be set above the pennant to reduce downside risk. This often provides traders with an adequate amount of protection.

Keep in mind that market movements aren't always what we anticipate, so risk management strategies should always be implemented before entering a trade.

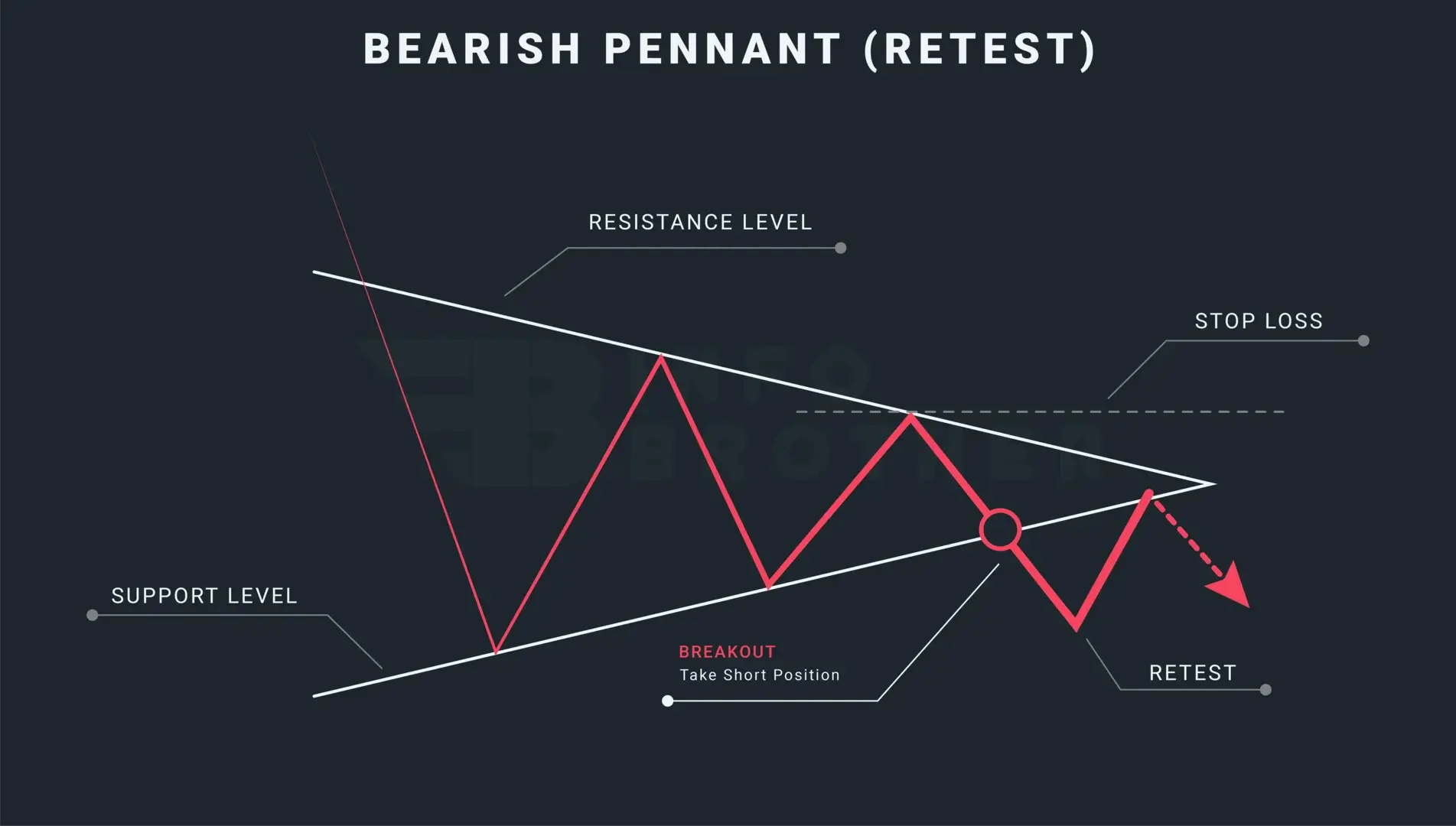

False breakouts might be a major problem with these patterns. Price may veer from the pattern just to re-enter it, or it may even break out in the other direction. Waiting for the retest will help a trader avoid this.

The process of the price returning to the level that the market previously broke is known as retesting. To avoid false breakouts, traders might wait for a retest, which occurs when the price breaks through the trendline and returns to retest the just passed resistance.

Sardar Omar

I did my hardest to present you with all of the information you need on this subject in a simple and understandable manner. However, if you have any difficulties understanding this concept or have any questions, please do not hesitate to ask. I'll try my best to meet your requirements.

Disclaimer:This material is provided purely for educational purpose and is not intended to provide financial advice.