eBOOK/PDF

No ads? No problem! You can download our tutorials in a printable PDF format or as an EPUB file, optimized for your tablet or eReader.

Bullish Flag Pattern

Bullish Flag Pattern Trading: Master Continuation Strategies in Uptrends.

Experienced traders have a wide range of methods at their disposal. The flag pattern, on the other hand, is one of the most popular and significant strategies. The flag patterns enable traders to engage in trending markets and comprehend price changes, as well as risk management measures to create low-risk entrances.

In this chapter, we'll look at what a bullish flag pattern is and how to spot one in a trending market. We'll also study trading tactics to make the bullish flag pattern more rewarding.

| Name: | Bullish Flag |

|---|---|

| Forecast: | Continuation Pattern |

| Trend prior to the pattern: | Uptrend |

| Opposite pattern: | Bearish Flag |

| Accuracy rate: | 98% |

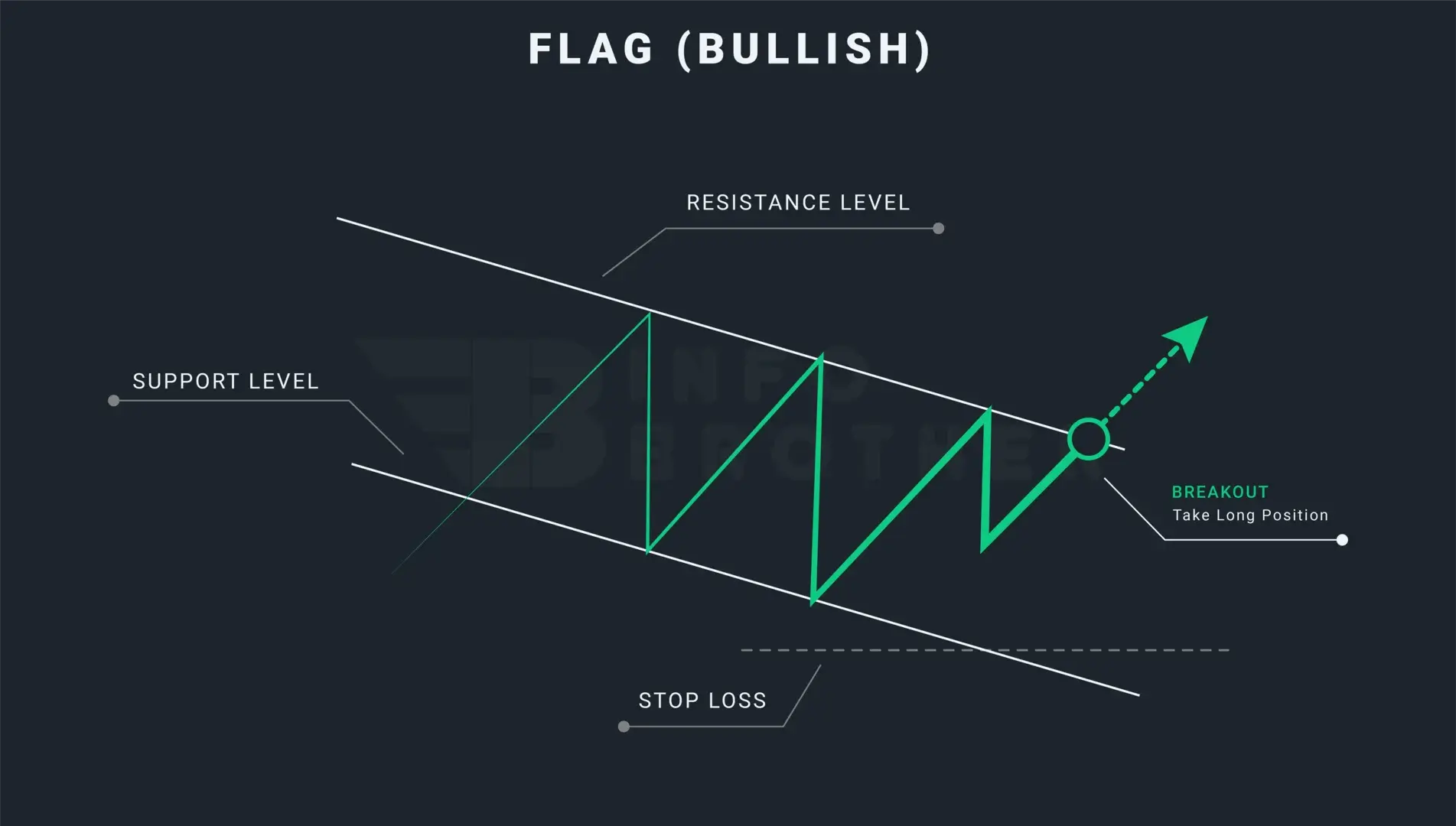

A bullish flag is a continuation pattern observed in markets with strong uptrends that informs traders that the trend will continue rising. We termed this formation a 'bullish flag' since it looks like a flag on a pole. The pole represents a significant vertical climb in the market, while the flag represents a period of consolidation. The flag can be a horizontal rectangle, but it is also found in an angle-down shape that is opposite the current trend.

Because of the tremendous trends that experienced investors may benefit from, the bulls' flag patterns are ideal for the cryptocurrency market circumstances. This pattern works well whether we want to utilize it for day trading or swing trading. Flag patterns are useful for trading after a breakout or in a market that is strongly moving.

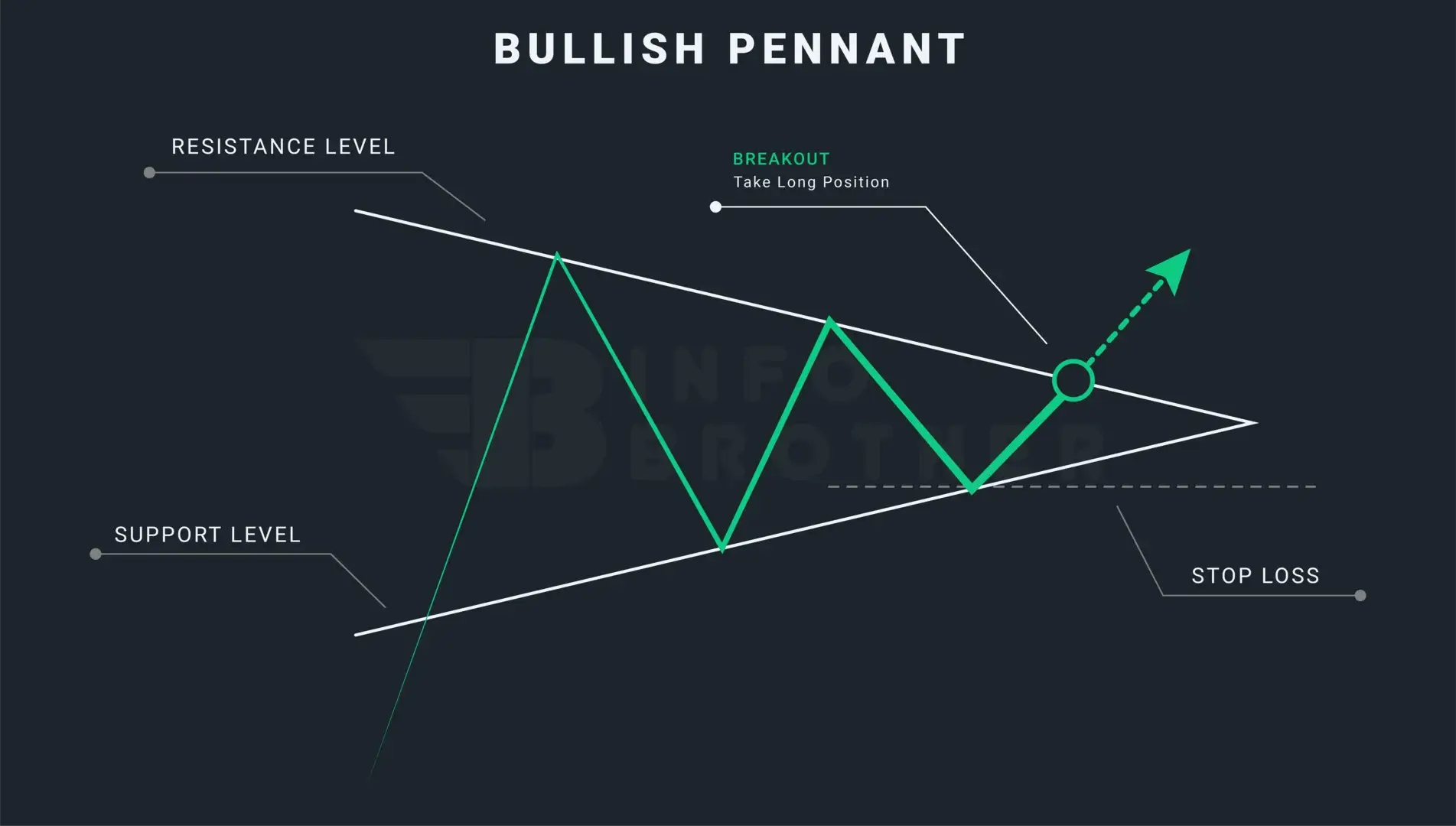

Most traders confuse flag patterns with pennant patterns. However, these two designs are diametrically opposed. The fundamental contrast between the flag pattern and the pennant pattern is the appearance of support and resistance levels inside the formations. Flag patterns are made up of two parallel lines, whereas pennant patterns are made up of support and resistance lines that converge on an apex.

The bull flag pattern is a chart pattern that extends the uptrend. Before breaking out and continuing the uptrend, price movement consolidates inside two parallel lines in the opposite direction of the upward trend. If this pattern happens within an uptrend, the trend has a 98% chance of continuing.

There are five factors to examine while determining a bullish flag pattern.

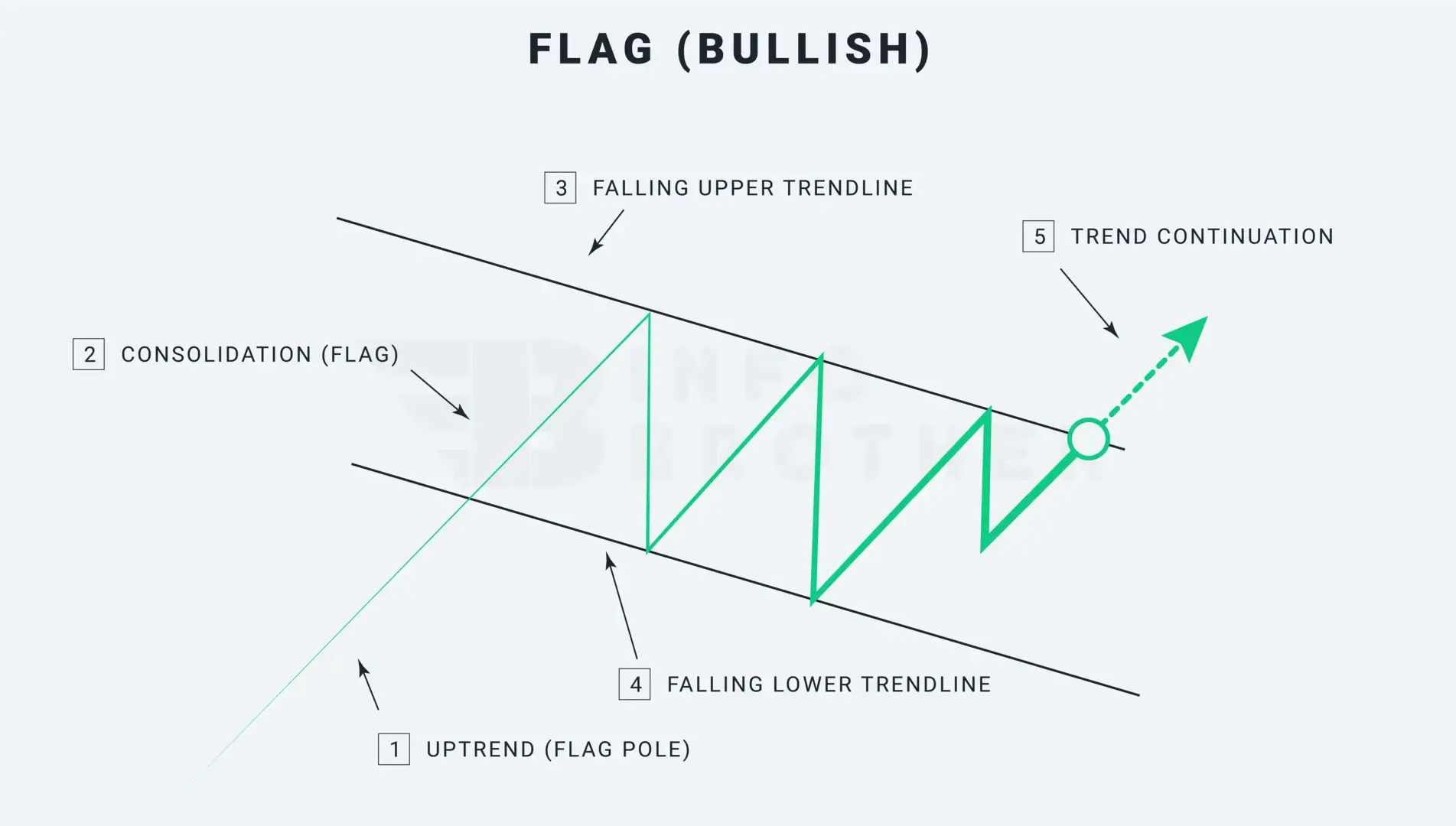

1. Uptrend (Flagpole)

Prior to the formation of the bullish flag pattern, the market must be in an upward trend. This design differs from others, such as the symmetrical triangle, in that it always begins with a flagpole. Traders should avoid this pattern if the trend is down or sideways.

What is the flag?

A "flag" is a term used in technical analysis. It is a pattern that develops anytime there is a strong gain or decline, followed by trading inside a small price range, and then it is finished off by another sharp rise or decline.

2.Consolidation Phase (Flag)

The market is undergoing a rapid increase before entering a period of consolidation. Following this consolidation period, the market will see another big upward trend to complete the pattern.

3. Falling upper trendine (resistance level)

During the consolidation period, link the highs to draw the declining trend line or resistance level. To build the upper trendline or resistance level, we need at least two swing highs. More trendline contacts, on the other hand, result in more dependable trading outcomes.

4. Falling lower trendline (support level)

During the consolidation period, link the lows to draw another falling trend line or support level. In order to build the lower trendline or support level, we must have at least two swing lows. More trendline contacts, on the other hand, result in more dependable trading outcomes.

Note that the support and resistance levels, or upper and lower trendlines, inside the formations of bullish flag patterns are two parallel lines running in the opposite direction of the uptrend.

5. Continuation of a Trend

In the event of a bullish flag pattern, the previous upward trend has resumed following the breakout when the price rises over the resistance level. The candle that emerges from the bullish flag formation should do so with high volume and at a rapid tempo. Bullish engulfing candles that breach the resistance line are common.

Flag pattern trendlines must have a minimum of two swing highs and two swing lows. More trendline interactions, on the other hand, result in more consistent trading outcomes.

The Difference Between a Flag Pattern and a Pennant Pattern:

The look of the support and resistance levels inside the formations is the primary distinction between a flag pattern and a pennant pattern.

Read More

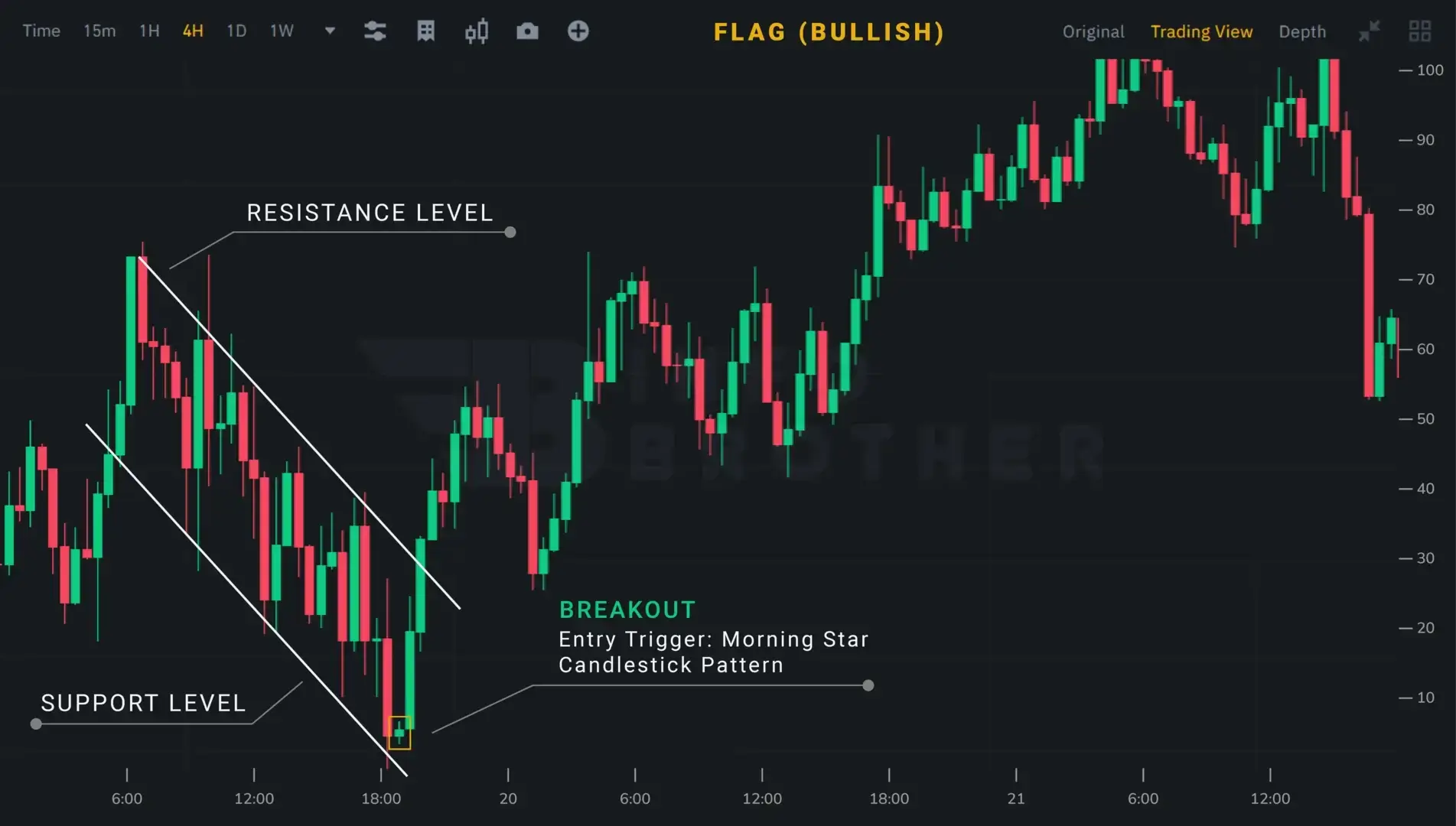

Trading the bull flag pattern is a simple process as long as the prior part, identifying and sketching the formation, is done correctly. The bull flag shapes and forms the upswing, allowing traders to pinpoint entry and limit levels.

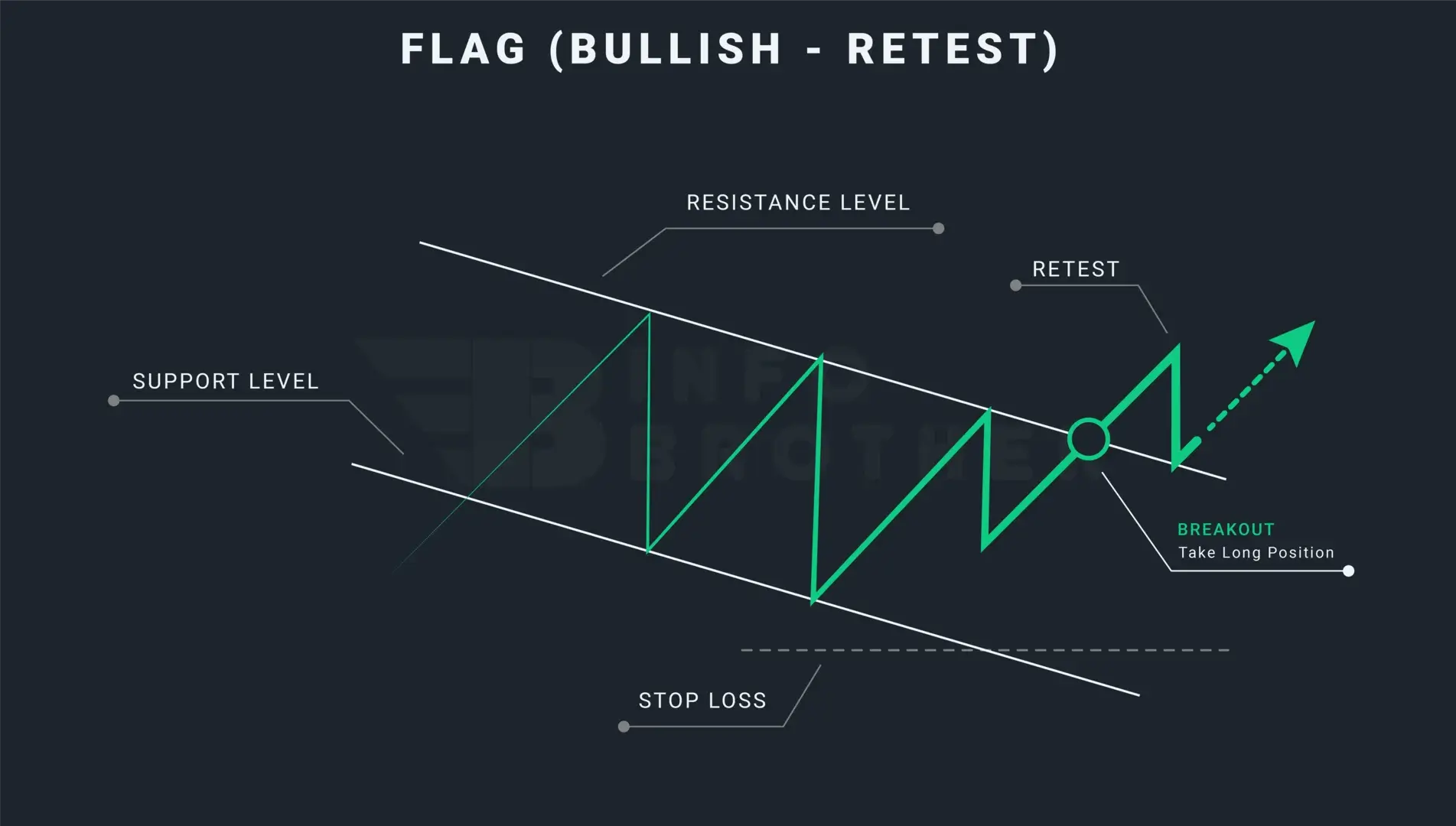

Traders enter at the close of the breakout candle or wait for the retest, which can be difficult because the price movement may never return to retest the broken resistance.

Any movement to the inside body of the flag renders the pattern invalid. To avoid false breakouts and market whipping in extremely volatile markets, we should follow the risk management rule and put the stop-loss right below the flag formation.

In the case of a take-profit, traders just copy and paste the flagpole from the point where the breakthrough occurred. The end point of the past trendline indicates a level where we should consider taking gains. At this moment, we will notice that the market reached this level and then slightly corrected lower, indicating that the take profit order of the bull flag has been reached.

Remember that market fluctuations aren't always predictable, so risk management methods should always be adopted before starting a trade. False breakouts may be a significant issue with these patterns. Price may deviate from the pattern only to re-enter it, or it may break out in the other direction. A trader can prevent this by waiting for the retest.

The process of the price returning to the level that the market previously broke is known as retesting. To avoid false breakouts, traders might wait for a retest, which occurs when the price breaks through the trendline and returns to retest the just passed resistance.

Sardar Omar

I did my hardest to present you with all of the information you need on this subject in a simple and understandable manner. However, if you have any difficulties understanding this concept or have any questions, please do not hesitate to ask. I'll try my best to meet your requirements.

Disclaimer:This material is provided purely for educational purpose and is not intended to provide financial advice.